Sudbury, January 16, 2014 – Transition Metals Corp. (XTM – TSX.V) ("Transition") and it's 83% owned private-subsidiary, Sudbury Platinum Corporation (SPC), are pleased to announce initial borehole geophysical results from the Aer-Kidd Project, located in the prolific Sudbury Basin. The surveys to date have identified two new highly conductive drill ready targets in addition to several other highly prospective electromagnetic (EM) drill targets. The 2014 exploration program will be focused on testing these high quality targets as well as expanding the geophysical coverage across the property with additional borehole EM surveys.

The 2013 Program

Ni-Cu-PGM massive sulphide orebodies of Sudbury Igneous Complex (SIC) are highly conductive. The portion of the Worthington Offset Dyke that transects the Aer-Kidd Property has been subject to previous geophysical investigation from surface and boreholes. As part of a review of this work SPC identified eleven historic drillholes to be re-surveyed. Of that total, six were re-surveyed with the Lamontagne UTEM IV ™ borehole electromagnetic system (BHEM) in 2013.

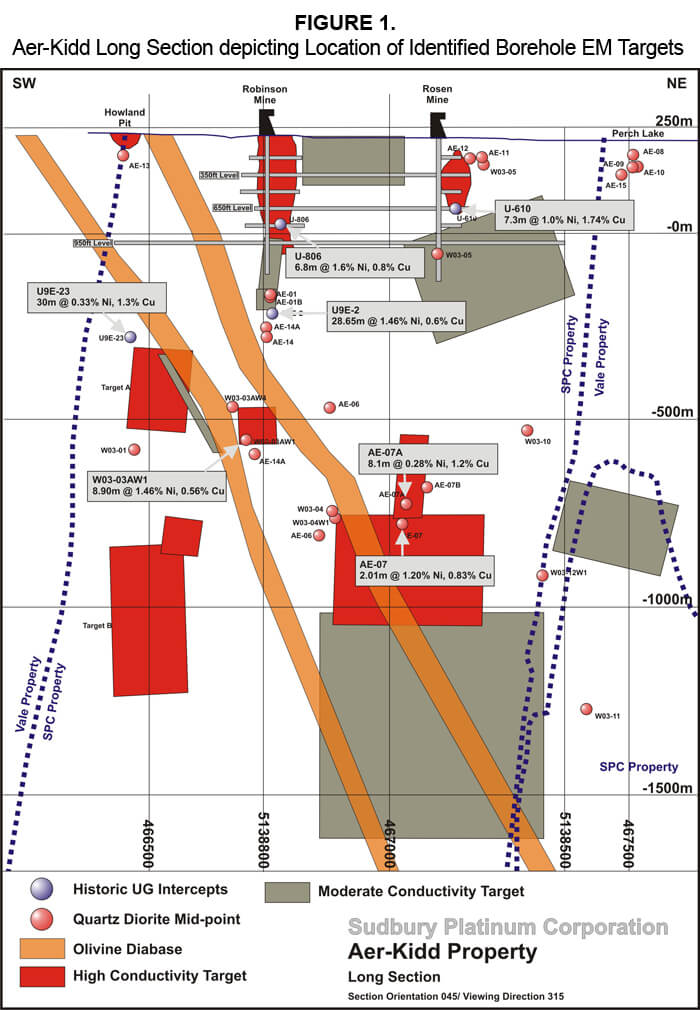

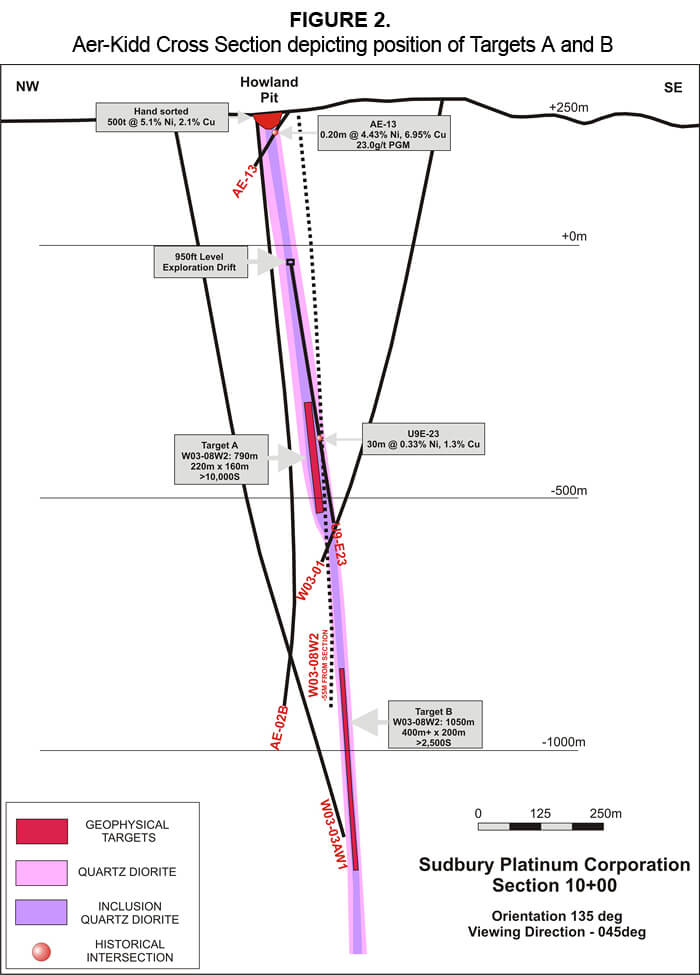

The highest priority targets were identified in hole W03-08W2. This hole was drilled by CaNickel formerly Crowflight Minerals (CML) in 2004 and was designed to test the offset dyke at a vertical depth of approximately 1,000 metres between the past-producing Robinson Mine and the Howland Pit. Due to excessive deviation during drilling, the hole failed to intersect the target dyke at depth. Resurveying of the hole in December 2013 by SPC revealed two highly conductive targets (Target A and Target B illustrated in Figure 1) coincident with the offset dyke, 700 metres and 1,050 metres downhole.

Target A: At 790 metres depth, an extremely conductive (>10,000 siemen) off-hole anomaly is logged in W03-08W2. The nearest edge of this feature is located approximately 20-30 metres up-dip and west of the hole and is modelled parallel to the dip of the offset dyke. The source conductor is estimated to extend upwards ~220 metres in dip extent and ~160 metres in strike extent.

Target B: From 1,050 metres to end of hole (1,200 metres), a building high conductivity (>2,500 siemen) off-hole conductor is evident in the survey profile. This strong conductor is sub-vertically oriented, and the vertical extent could exceed >400 metres down-dip and 200 metres of strike extent.

Both conductors are located within the down-plunge projection of the historic Howland Pit, which in 1914 produced 486 tons grading 5.1% Ni and 2.1% Cu. Drilling by CML in 2001 intersected narrow high-grade mineralization beneath the former pit in hole AE-13 that graded 4.43% Ni, 6.95% Cu and 23g/t Pt+Pd+Au or PGM over 0.20 metres. Underground drilling in the 1960's from the 950 foot level (290 metre) exploration drift returned 30 metres averaging 0.33% Ni and 1.3% Cu (U9-E23) in close proximity to the up-dip edge of Target A. Based on the location of the targets relative to the historical drilling it is anticipated that these targets can be tested efficiently by wedging off existing historical holes.

In addition to targets A and B, eleven additional conductive targets have been modelled from the data collected. These targets are located within the down-plunge projection of known historic ore zones (Howland Pit, Robinson Mine and Rosen Mine) and some have known more recent drill intersections associated with the targets.

Commenting on the results, Chief Geophysicist, Kevin Stevens, P.Geo. stated "The UTEM system is proven to be effective at discriminating massive sulphide deposits from the disseminated sulphide halos often encountered in SIC ore bearing systems. In my personal experience, having interpreted 100's such logs in the SIC, the UTEM responses obtained from the recent round of surveys are of a quality consistent with survey results that have led to the successful discovery of economic Ni-Cu-PGE deposits elsewhere in the SIC."

2014 Program

SPC is now carrying out a re-logging program of selected core with plans to resurvey all remaining accessible historic holes using the UTEM IV system in the coming weeks. Results from the work will be integrated with the geological model in advance of the 4,000m of drilling planned for 2014.

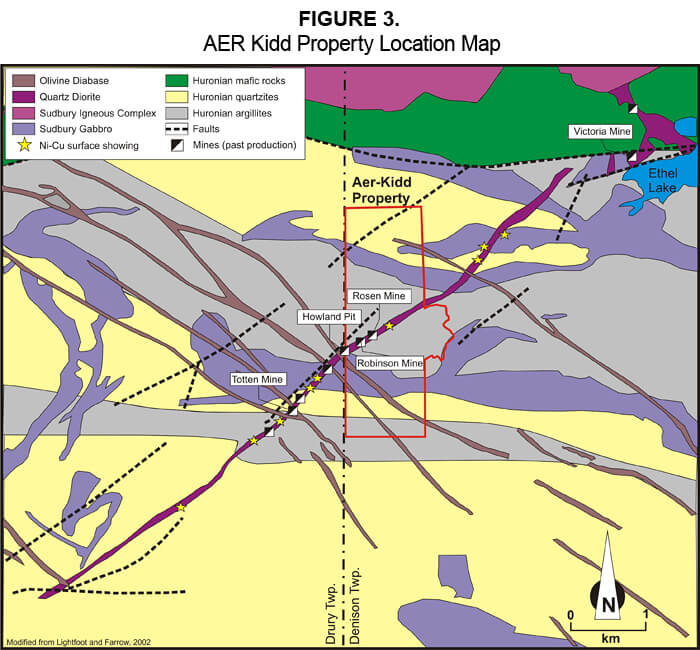

Please refer to Figures 1 through 3 which depict the location of these targets in both long-section and cross section views along with a general location map depicting the location of the Aer Kidd property. If you are having difficulties viewing the figures please visit the Aer Kidd project sections at www.transitionmetalscorp.com or use the following link: http://www.transitionmetalscorp.com/images/stories/News/Sudbury_Platinum_BH_Targets.pdf to download the pdf version of this release.

About the Aer-Kidd Property

The Aer-Kidd Property is located ~20 kilometres southwest of Sudbury, Ontario and covers a 1.3 kilometer section of the Worthington Offset Dyke in an area with a rich mining history, dating back to the 1800's. The property is approximately 2.6 kilometers along strike to the northeast of Vale's Totten mine (10.1 million tonnes grading 1.5% Ni, 1.97% Cu, 4.8g/t PGM)¹ that is currently in production and 4.3 kilometers to the southwest and along trend of KGHM's Victoria mine (14.5 million tonnes grading 2.5% Ni, 2.5% Cu, 7.6 g/t PGM)² which is currently being developed. The Aer-Kidd Property hosts the former producing Howland Pit, Robinson and Rosen Mines, which were small deposits exposed at surface and were mined down to a maximum depth of 300 metres. SPC has undertaken a detailed review of historical geophysical and geological data and believes that the property maintains excellent potential to host an economic Ni-Cu-PGM deposit.

Qualified Person

The technical elements of this news release have been approved by Mr. Grant Mourre, P.Geo (APGO), a Qualified Person under National Instrument 43-101. Information used in this release of a historical nature has not been verified by the Company hence should not be relied upon.

1 Resource reported by Inco; January 31, 2001 News Release

2 Resource reported by KGHM; January 16, 2012 News Release.

About Transition Metals Corp

Transition Metals Corp (XTM -TSX.V) is a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into Canadian discoveries. The award-winning team of geoscientists has extensive exploration experience in established, emerging and historic mining camps, and actively develops and tests new ideas for discovering mineralization in places that others have not looked, which often allows the company to acquire properties inexpensively. The team is rigorous in its fieldwork, and combines traditional techniques with newer ones to help unearth compelling prospects and drill targets. Transition uses the project generator business model to acquire and advance multiple exploration projects simultaneously, thereby maximizing shareholder exposure to discovery and capital gain. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder's equity dilution. The company, which went public in 2011, has an expanding portfolio that currently includes 28 gold, copper, nickel and platinum projects primarily in Ontario, Nunavut and Saskatchewan.

About Sudbury Platinum Corp

Sudbury Platinum Corp. is a Canadian private corporation focused on exploring for nickel, copper and platinum group metals in the Sudbury region. The company is exploring its key Aer-Kidd Property, an advanced exploration property located on the prospective Worthington Offset dyke, in the heart of the Sudbury mining camp and holds a 100% interest in the Owen Nickel property. The Company vision is to become a mine developer in the Sudbury district. Additional information regarding the company and project can be found on the Transition Metals Web Site.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in this news release constitutes "forward-looking information" within the meaning of Canadian securities law. Such forward-looking information may be identified by words such as "plans", "proposes", "estimates", "intends", "expects", "believes", "may", "will" and include without limitation, statements regarding estimated capital and operating costs, expected production timeline, benefits of updated development plans, foreign exchange assumptions and regulatory approvals. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, competition, risks inherent in the mining industry, and regulatory risks. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the Company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information is available at www.transitionmetalscorp.com or by contacting:

Scott McLean

President and CEO

Transition Metals Corp.

Tel: (705) 669-0590

Robert Thaemlitz

Financial Communications

Renmark

Tel. 514.939.3989