Sudbury, March 5, 2018 – Sudbury Platinum Corporation (“SPC”) and Transition Metals Corp. (XTM – TSX.V, “Transition”, “the Company”) are pleased to provide a project update and to announce assay results from fall drilling completed at the company’s Aer-Kidd Project, near Sudbury Ontario. During a period from November to December the company completed eight holes for a total of 1,371m designed to evaluate the up-dip and down-dip potential of the past-producing Rosen and Robinson Mines which are located on the property adjacent to Vale’s producing Totten mine. SPC is a private company that is 36% owned by Transition.

Highlights:

- AK-17-020 intersected 12.35m containing 0.91% Ni, 0.28% Cu, 0.03% Co and 0.80g/t PGM (Pt+Pd+Au) from 70.55-82.90m including a higher grade section of 2.05% Ni, 0.17% Cu, 0.05% Co and 1.03g/t PGM over 2.60m immediately up-dip of the past producing Rosen Mine.

- Borehole Geophysics in AK-17-025, testing down-dip of the past producing Robinson Mine, indicate strong previously untested offhole EM conductors proximal to areas of known historic high-grade Ni-Cu mineralization (U9-E2: 28.7m @ 1.48% Ni, 0.61% Cu4).

Scott McLean, P.Geo., CEO of SPC stated, "The near surface mineralization that includes significant intercepts of PGM’s and cobalt is encouraging and demonstrates that we are continuing to explore a highly prospective part of the Sudbury Igneous Complex. The property remains wide open at depths where drilling on the adjacent properties has discovered world class deposits at Totten and Victoria.”

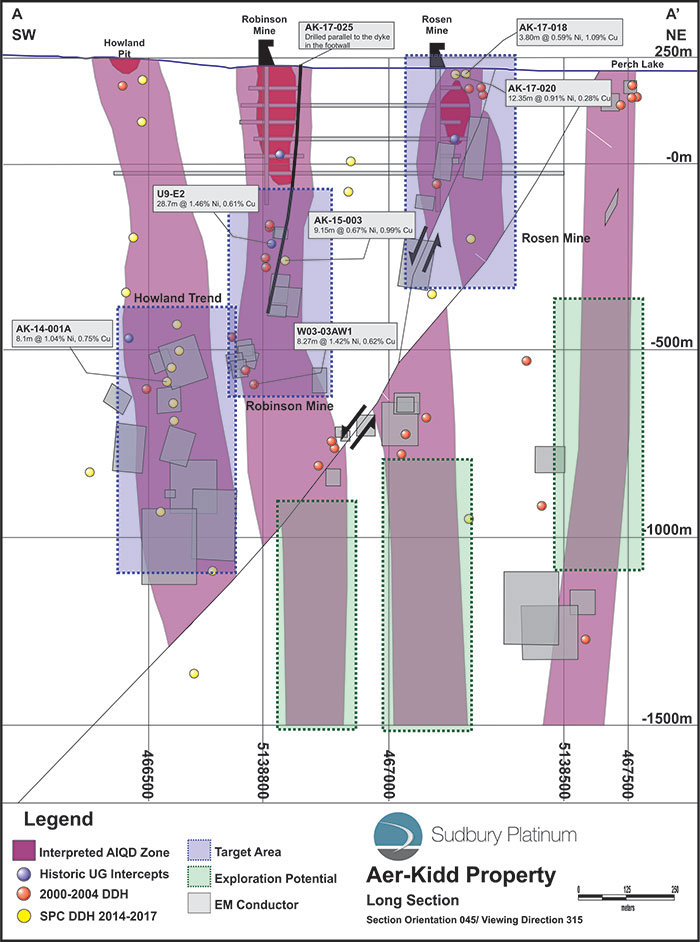

This release only discloses assay results from two holes, AK-17-018 and AK-17-020, completed during the previously mentioned winter drill program. The remaining assays are pending. Figure 1 is a long section of the property looking northwest that includes the pierce points of recent drilling.

Table 1: Highlight Drill Intersections

| Hole | From (m) | To (m) |

Length* (m) | Ni wt.% | Cu wt.% | Co wt.% | Pt g/t | Pd g/t | Au g/t | Ag g/t | PGM g/t |

| AK-17-018 | 7.90 | 8.35 | 0.45 | 1.79 | 0.29 | 0.03 | 0.53 | 0.15 | 0.08 | 4.50 | 0.76 |

| and | 10.60 | 14.40 | 3.80 | 0.59 | 1.09 | 0.02 | 0.73 | 0.25 | 0.10 | 7.98 | 1.08 |

| and | 83.80 | 84.00 | 0.20 | 2.11 | 0.05 | 0.11 | 1.06 | 0.91 | 0.41 | 1.80 | 2.38 |

| AK-17-020 | 70.55 | 82.90 | 12.35 | 0.91 | 0.28 | 0.03 | 0.46 | 0.23 | 0.11 | 1.97 | 0.80 |

| including | 70.55 | 73.90 | 3.35 | 1.17 | 0.41 | 0.03 | 0.28 | 0.07 | 0.04 | 2.54 | 0.39 |

| including | 80.30 | 82.90 | 2.60 | 2.05 | 0.17 | 0.05 | 0.64 | 0.26 | 0.13 | 1.58 | 1.03 |

| including | 81.15 | 81.50 | 0.35 | 5.22 | 0.04 | 0.11 | 0.57 | 0.09 | 0.02 | 1.40 | 0.68 |

Note: * All intercepts reported are down hole lengths, not true thicknesses. Insufficient drilling has been completed to date to define the orientation of the mineralized zone in space.

Table 2: Drill Hole Orientation Data

| Hole | Area | Easting* | Northing* | Length (m) | Azimuth | Dip |

| AK-17-018 | Rosen Mine | 467,174 | 5,138,321 | 99.3 | 170˚ | -85˚ |

| AK-17-019 | Rosen Mine | 467,174 | 5,138,321 | 138.0 | 164˚ | -75˚ |

| AK-17-020 | Rosen Mine | 467,160 | 5,138,316 | 129.0 | 160˚ | 85˚ |

| AK-17-021 | Rosen Mine | 467,142 | 5,138,304 | 70.0 | 144˚ | -84˚ |

| AK-17-022 | Rosen Mine | 467,160 | 5,138,297 | 46.0 | 150˚ | -88˚ |

| AK-17-023 | Rosen Mine | 467,143 | 5,138,277 | 71.7 | 60˚ | -89˚ |

| AK-17-024 | Robinson Mine | 466,798 | 5,138,110 | 136.0 | 172˚ | -76˚ |

| AK-17-025 | Robinson Mine | 466,798 | 5,138,110 | 681.0 | 160˚ | -79˚ |

Note: * Coordinate system is NAD 83 Zone 17. Hole AK-17-024 was abandoned at 136m due to excessive deviation.

Discussion of Results

Aer-Kidd Property

Located within the SW corner of the prolific Sudbury Basin the Aer-Kidd Property consists of a 1.4 km section of the Worthington Offset Dyke (WOD). The WOD hosts several high-grade Ni-Cu-PGM deposits including Vale's Totten Mine (10.1Mt @ 1.5% Ni, 1.97% Cu, 4.8g/t PGM)¹ located 1.8 km NE of the Aer-Kidd Property and KGHM’s Victoria Project (14.5Mt @ 2.5% Ni, 2.5% Cu, 7.6 g/t PGM)² located 3.0 km NW of the Aer-Kidd Property. On the property the WOD consists of a NW-SE trending, steeply dipping composite dyke ranging in width from 40 to 70m. The dyke displays a distinct zonation in both inclusion and sulphide contents from the margin to the core of the dyke. Locally, the dyke contains a core of inclusion-rich quartz diorite (IQD), which can be choked with inclusions surrounded by high-grade semi-massive to massive sulphide mineralization. The orebodies within the WOD are primarily hosted within discontinuous phases of the IQD that contains 10 to 80 percent amphibolite inclusions (AIQD) that can range in size from less than 10cm to greater than 10m in diameter. Zones of AIQD form discontinuous lenses within the center of the dyke that can range in size from a few 10’s of metres up to 100’s of metres in length and width while the vertical extents of these zones can be greater than 1,000 metres.

Past Production

The Aer-Kidd Property hosts three past producing Ni-Cu-PGM mines, the Howland Pit, Robinson Mine and the Rosen Mine all of which are associated with pipe-like zones of AIQD. The Howland Pit was a small open pit operation that was discovered in 1884 and produce <1,000 tons of high-grade ore. The Robinson and Rosen Mines were discovered in the late 1880’s and were eventually put into production in 1966. Pre-production reserves at Robinson were estimated at 497,744 tons3 grading 0.62% Ni, 0.71% Cu (above the 800ft level) while at Rosen the reserves were estimated at 274,5603 tons at a similar grade. Production lasted for three years period from 1966 to 1968 during which an estimated 462,743 tons3 of ore were hoisted from the two deposits with the bulk coming from the Robinson Mine.

Work to date

Since 2014, SPC has completed 18,768m of drilling in 27 holes testing the property for geological environments similar to those that hosted the Robinson and Rosen Mines. The majority of the drilling has focused on testing the deep (>1,000m) down-dip potential of the Howland, Robinson and Rosen mineral trends, focusing on areas of known or interpreted AIQD, borehole geophysical anomalies and known historic drill intersections. Drilling to date has identified three new areas of massive sulphide mineralization up-dip and down-dip of the past producing Howland, Robinson and Rosen Mines, as well, detailed 3-D geological modeling has identified three additional high-priority target areas requiring further exploration.

Howland Trend (down-dip)

Initial drilling was done to test a strong BHEM conductor that was identified in 2013 as part of the extensive BHEM program that was completed across the property (see January 16th, 2014 News Release). Initial drilling intersected high-grade mineralization (see March 2nd, 2015 News Release) within a thick and extensive zone of AIQD. Highlights include AK-14-001A that intersected 8.1m @ 1.04% Ni, 0.75%Cu, 0.05% Co and 2.4g/t PGM from 900.8-908.9m including a higher grade section of 2.47% Ni, 2.47% Cu, 0.12% Co and 10.18g/t PGM over 1.65m. Drilling has outlined a 250m by 500m area of well-developed and extensive AIQD containing numerous sulphide intersections as well many untested or partially tested EM conductors that SPC feels remains to be fully evaluated.

Robinson Mine (down-dip)

Area was initially targeted to test for a potential down-dip extension to the Robinson Mine. Historic drilling completed by Kidd Copper in 1968 returned 1.46% Ni, 0.61% Cu over 28.7m (U9-E2)4 approximately 150m beneath the 950ft level of the Robinson Mine while Crowflight Minerals Inc. reported 1.42% Ni, 0.62%Cu and 1.76g/t PGM over 8.27m (W03-03AW1)5 approximately 500m beneath the 950ft level. In 2015, SPC further tested this area with AK-15-003 and intersected 0.67% Ni, 0.99% Cu, 0.02% Co and 1.46g/t PGM over 9.15m (see May 25th, 2015 News Release). Mineralization within this area occurs as either Cu-rich disseminated to blebby sulphides, as in AK-15-003, or as massive sulphides associated with well-developed zones of AIQD, such as in W03-03AW1. Borehole geophysical surveys in the area have identified several high-conductivity anomalies that remain to be tested. As part of the 2017 winter drill program, SPC completed hole AK-17-025 that was collared within the footwall to the Robinson Mine and was designed to be a geophysical platform hole down to a vertical depth of 600m. The results of survey indicate a strong offhole anomaly 25 to 50m down-dip of the intersections in hole U9-E2 and AK-15-003. Drilling has outlined a 200m by 600m area extending from the base of the Robinson Mine of well-developed and extensive AIQD containing numerous sulphide intersections as well many untested or partially tested EM conductors that SPC feels remains to be fully evaluated.

Rosen Mine

Historical documents indicated that at the time of development (1966) the Rosen Mine was estimated to of contained 274,560 tons of ore grading 0.62% Ni and 0.71% Cu (above 200m vertical). From 1967 to 1969 an undisclosed amount ore was extracted from the Rosen Mine on two main levels (350 and 650ft levels) and one sub-level (500ft level). After a detailed review of the available mine sections and plans SPC concluded that the bulk of the ore produced on the Aer-Kidd Property came from the Robinson Mine and therefore potential existed for ore to remain in the ground at the former Rosen Mine. In the winter of 2017, SPC drilled 554m in six holes to test for a possibly up-dip extension of the Rosen Mine as well as to assess the overall potential of the past-producing Rosen Mine. Highlights of the program include AK-17-020 that intersected 12.35m containing 0.91% Ni, 0.28% Cu, 0.03% Co and 0.80g/t PGM (Pt+Pd+Au) from 70.55-82.90m including a higher grade section of 2.05% Ni, 0.17% Cu, 0.05% Co and 1.03g/t PGM over 2.60m. Mineralization occurred as massive and semi-massive sulphides within a 23.0m thick zone of AQID that contained >50% inclusions ranging in size from 0.2 to 2.55m in diameter. All of the remaining holes not reported intersected smaller (typically <1m in core length) zone of massive and semi-massive sulphides. SPC feels that the initial drill results up-dip of the Rosen Mine are positive and that further work should be completed to fully evaluate the potential of the area.

Exploration Potential

Following a reinterpretation of the Aer-Kidd geological data, SPC has identified three high-priority target areas between 750 and 2,000m vertical that are interpreted to represent the deep down-dip extensions of the Howland, Robinson and Rosen mineralized AIQD trends. A newly recognized NW-SE trend SW dipping normal fault has been interpreted to of offset the shallower portions of the AIQD trends by as much as 300 to 400m resulting in a repositioning of the down-dip extensions of the Howland, Robinson and Rosen trends. SPC intends on exploring these areas with diamond drilling and borehole EM surveys.

References

1 Resource reported by Inco; January 31, 2001 News Release.

2 Resource reported by KGHM; January 16, 2012 News Release.

3 Robinson and Rosen Mine Reserve Estimate; 1968-1969 Can. Mines Handbook.

4 ‘Kidd Copper Suspension Lasted One Week’; Northern Miner Article, January 4, 1968, No 41, pg14.

5 Crowflight Minerals Inc.; February 05, 2004 News Release.

Qualified Person

The technical elements of this news release have been approved by Mr. Grant Mourre, P.Geo (APGO), a Qualified Person under National Instrument 43-101. All samples were analyzed in Vancouver by ALS Chemex. Platinum, palladium and gold values were determined together using standard lead oxide collection fire assay and ICP-AES finish. Base metal values were determined using sodium peroxide fusion and ICP-AES finish. Silver values were determined using an aqua regia digestions and an AAS finish. A Certified Reference Material (CRM) standard, blank or duplicate is inserted on every 10th sample in the following order: CRM, blank, CRM, duplicate. The cycle repeats every 40 samples, thus ensuring that 10% of samples submitted are control samples. Laboratory checks are also done with one sample in every batch (max 40 samples) being submitted to an external lab for comparison.

About Sudbury Platinum Corporation

Sudbury Platinum Corporation, a private corporation 36% owned by Transition Metals Corp (XTM –TSX-V), is a Canadian private corporation focused on exploring for Ni-Cu-PGM in the Sudbury region. The Company is exploring its key 100% owned Aer-Kidd Property, an advanced exploration property located on the prospective Worthington Offset Dyke, in the heart of the Sudbury mining camp and holds a 100% interest in the Owen Nickel Property. The Company vision is to become a mine developer in the Sudbury district. Additional information regarding the company and project can be found at www.sudburyplatinumcorp.com

About Transition Metals Corp.

Transition Metals Corp (XTM -TSX.V) is a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into Canadian discoveries. The award-winning team of geoscientists has extensive exploration experience in established, emerging and historic mining camps, and actively develops and tests new ideas for discovering mineralization in places that others have not looked, which often allows the company to acquire properties inexpensively. The team is rigorous in its fieldwork, and combines traditional techniques with newer ones to help unearth compelling prospects and drill targets. Transition uses the project generator business model to acquire and advance multiple exploration projects simultaneously, thereby maximizing shareholder exposure to discovery and capital gain. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder's equity dilution. The company, which went public in 2011, has an expanding portfolio that currently includes >25 gold, copper, nickel and platinum projects primarily in Ontario, Nunavut and Saskatchewan.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in this news release constitutes "forward-looking information" within the meaning of Canadian securities law. Such forward-looking information may be identified by words such as "plans", "proposes", "estimates", "intends", "expects", "believes", "may", "will" and include without limitation, statements regarding estimated capital and operating costs, expected production timeline, benefits of updated development plans, foreign exchange assumptions and regulatory approvals. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, competition, risks inherent in the mining industry, and regulatory risks. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the Company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information is available at www.sudburyplatinumcorp.com or by contacting:

Scott McLean

Chief Executive Officer

Sudbury Platinum Corporation

www.sudburyplatinumcorp.com

Tel: (705) 669-1777

Download PDF

AK Long Section