Sudbury, March 4, 2013 - Transition Metals Corp. (XTM – TSX.V) ("Transition") and HTX Minerals Corp. ("HTX"), a private company incorporated under the laws of Ontario, are pleased to announce that they have entered into a letter of intent dated March 3, 2013 (the "LOI") to combine the businesses. Transition and HTX ("the Parties") intend to implement a plan of arrangement pursuant to which Transition will acquire all of the securities of HTX in exchange for common shares of Transition. It is expected that the business combination will be by means of a plan of arrangement pursuant to Section 182 of the Business Corporations Act (Ontario) (the "Proposed Transaction"). However, the final structure of the Proposed Transaction will be determined collectively by Transition and HTX based on taxation, securities and corporate law, and other considerations.

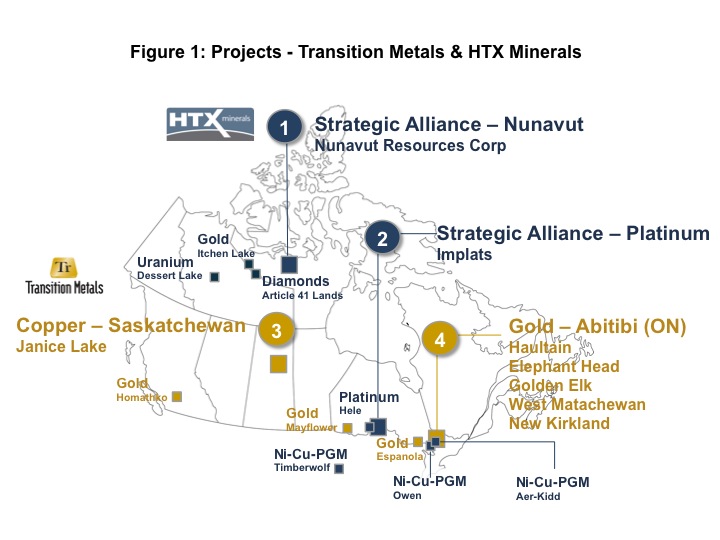

"This is very positive for the shareholders, employees and partners of both companies," said Scott McLean, CEO of both Transition Metals and HTX Minerals. "The combined entity will be a much larger project generator focused on the discovery of gold, platinum and base metal deposits in Canada. With an award-winning and highly experienced team of geologists, strategic exploration alliances with Implats and the Nunavut Resources Corporation, JV partnerships, and a portfolio of 20 projects in Ontario, Nunavut, Saskatchewan and BC (Figure 1), the company will be further positioned for growth and success."

Highlights of the Combined Business:

The following are the key attributes of a combined business. The contribution of each company is noted in parentheses as "Transition", "HTX", or "Transition + HTX" in the event they contribute equally or share the attribute.

Experienced Exploration & Management Team: (Transition + HTX) The team of eight geoscientists has extensive experience exploring for Ni-Cu-PGE, gold and base metals in Canada, and three of the senior geologists have been recognized for their key contributions to the discovery of new deposits. In addition to its exploration expertise, the management team has extensive joint venture negotiation, financial and marketing expertise and has previous operational experience at both small and large companies.

Project Generator: (Transition + HTX) The project generator business model maximizes shareholder exposure to discovery, while minimizing shareholder equity dilution by relying on partners to fund more expensive drilling and exploration.

Strategic / Regional Alliances: (HTX) Strategic alliance with Implats, the world's second largest producer of platinum, to explore the Mid Continent Rift region in Ontario for platinum group element deposits, with 2012 funding of $1.3 million. Strategic alliance with the Nunavut Resources Corp. (NRC) for mineral project generation and exploration, including precious, base and strategic metals, and diamonds in the Kitikmeot Region of the Territory of Nunavut. As part of this agreement, which has an initial term of five years, the NRC will seek a minimum of $18 million to be spent on exploration within the region. NRC has currently raised $1 million and is actively seeking investment partners.

Joint Venture Partnerships: Exploration expenditures committed by HTX joint venture partner Implats totaled approximately $400,000 in 2012, and by Transition JV partners Gowest Gold and Abalor Minerals approximately $1 million.

Haultain Gold: (Transition) 2010/11 discovery of high-grade gold mineralization at Haultain property in the southern Abitibi region exhibits geological similarities to deposits in the Kirkland Lake area. A >1200m long gold mineralized trend is open in all directions and appears to extend onto the property recently acquired by Transition, which is adjacent to and west of the Haultain discovery.

Abitibi Gold: (Transition) Strong pipeline of six gold projects, each with gold mineralization at surface, in the southern Abitibi greenstone. This area is seeing significant activity along the western extension of the Cadillac-Larder break, including at AuRico Gold's new Young- Davidson mine, and along the Ridout break (Iamgold's acquisition of Trelawney Mining), which runs parallel to the Cadillac-Larder break.

Sedimentary-hosted Copper: (Transition) Janice Lake sedimentary-hosted copper project in northern Saskatchewan has the potential to host large tonnage, near-surface economic copper deposits. Drill intercepts by previous operators include 33 metres @ 0.77% Cu, with surface grab samples collected by Transition up to 9.4% Cu. Numerous untested targets remain.

Itchen Lake: (HTX) The ~200 km2 Itchen Lake gold property is located 365 km northeast of Yellowknife in Nunavut and is wholly owned by HTX. The Lupin gold mine, which produced in excess of 3.3 million troy ounces of gold at an average grade of 9 g/t, from 1982-2004 (Harron, 2012) is located approximately 85 km east of the Itchen Lake property1. Historical exploration at Itchen between 1960 and 1993 resulted in the identification of numerous gold occurrences associated with banded iron

formation. Results from bedrock grab sample assays by HTX include 3.6 g/t Au, 11.8 g/t Au and 59.0 g/t Au, and support the validity of historical assays and the prospectivity of the area.

Aer-Kidd: (HTX) This 260 ha Ni-Cu-PGE property is situated along the Worthington offset dyke ~25 km southwest of Sudbury, Ontario. Although the property has been mined intermittently from 1916 to 1968, there are numerous untested targets below the mine workings, and at depth. Vale and KGHM are each spending upwards of $750 million to develop or mine orebodies that were discovered at depth below surface workings, within ~2 km to the west and 4 km to the east, respectively, of Aer-Kidd.

Directors and Officers

The parties anticipate that upon completion of the Transaction and subject to the approval of the TSX-V, the board of directors of the combined business shall consist of seven members, including all of the non-executive board members of both Transition and HTX, as follows:

Scott McLean, H.BSc., P.Geo.: Scott is an award-winning exploration geologist and the co- founder and CEO of Transition Metals and HTX Minerals with over 25 years of experience in all facets of exploration. During his 22 years at Falconbridge Limited, Scott's responsibilities included base metal exploration and underground production geology in Timmins, and most recently as Sudbury exploration manager, where he was responsible for underground and surface exploration. In 2004, he was a co-recipient of the PDAC Prospector of the Year Award for the discovery of the Nickel Rim South (Ni-Cu-PGE) mine, in Sudbury. Scott graduated with an Honours B.Sc from the University of Western Ontario in 1985, is a P.Geo and is also past-president of APGO, the Association of Professional Geoscientists of Ontario.

Tom Atkins, B.Sc., MBA: Mr. Atkins is an accomplished mining executive who has successfully lead exploration and development initiatives in the Americas over the past 28 years. He has an extensive background in geology, investment banking, investor relations, management and corporate governance. As a director of investment banking for CIBC World Markets, Mr. Atkins participated in raising over $1.7 billion in combined equity and debt related capital for numerous small to large capitalization companies and advised on numerous M&A mandates. Mr. Atkins was formerly the CEO of such companies as Rockex Ltd (now Rockex Mining, TSX listed iron ore company), Castle Gold Corp. (acquired in 2010 by Argonaut Gold Inc, TSX listed gold producer), and Crowflight Minerals Inc. (now TSX-listed CaNickel Mining Ltd.). Mr. Atkins holds a Bachelor of Science degree in Geology from McMaster University, and a Masters of Business Administration degree from the University of Western Ontario (now Ivey Business School), Canada.

Jon G. Baird, B.Sc., P.Eng.: Jon has been in the exploration and mining industry for over 40 years. He made his mark as the geophysicist responsible for the discovery of the Pyramid Mine, the largest lead-zinc ore body in the Pine Point NWT camp and later as Vice-President and Director of Scintrex Limited, where he led a world-wide marketing and sales campaign that helped make the company a leader in the field of mineral exploration geophysical instrumentation. He is also past President of the Prospectors and Developers Association of Canada and is currently Managing Director for the Canadian Association for Mining Equipment and Services for Export (CAMESE).

Jason Marks, B.E.Sc., MBA: Jason oversees firm and individual portfolios at GMP Investment Management, including overall allocation strategy and risk management. Prior to GMPIM, he was a Vice Chair at TD Securities and a Senior Vice President at TD Bank. Over his 11 years at TD Securities, Jason was responsible for various businesses including international proprietary trading, equity derivatives, interest rate derivatives, energy trading and structured products, risk management and credit policy. Prior to being employed at TD Bank, he was a Vice President at Citibank Canada where he was responsible for a number of derivative and structured product businesses. He has a M.B.A. from Harvard University(1989) and a B.E.Sc. (engineering) from the University of Western Ontario (1986).

Brian L. Montgomery, B.A., LLB: Brian is a lawyer with Weaver Simmons in Sudbury and is considered a local expert in all aspects of Mining, Corporate, Real Estate and Business Law. Brian was called to the Ontario Bar in 1973 and has a strong community focus in Sudbury having sat on numerous boards including Greater Sudbury Utilities Inc., Idylwylde Golf & Country Club, Sudbury Theatre Centre, Sudbury Chamber of Commerce, andSudbury YMCA.

Bill Pearson, Ph.D: Bill is a professional economic geologist with over 35 years of experience in the national and international mining industry in all phases from grassroots exploration through to advanced projects and mine development. He has carried out exploration programs in 15 countries in North and South America, Europe, East Asia and Australia, and is on the Board of several public junior mining companies. Bill is the former Vice President, Exploration for Desert Sun Mining Corp. (prior to April 2006 takeover by Yamana Gold Inc.), and was also previously the Executive Vice President, Exploration for Central Sun (prior to April 2009 takeover by B2Gold Inc.). He received a B.Sc. in Geology Honours in 1974 from UBC and M.Sc. and Ph.D. degrees in Economic Geology in 1977 and 1980 respectively from Queen's University.

W.S. (Steve) Vaughan, B.Sc, M.A. LLP.: Steve is a partner at Heenan Blaikie and a leading expert on mining and natural resources law. For more than four decades, Steve has advised and represented Canadian and international companies, served on many governmental advisory committees and, in recent years, has been involved in natural resources transactions in more than 65 countries. Steve is or has been a member or director of natural resource and mining companies such as Algoma Central Corporation, Pure Nickel, Inc.,Solomon Resources Limited, and Western Troy Capital Resources, among others, as well as numerous professional and trade associations including the Toronto Branch of the Canadian Institute of Mining, Metallurgy and Petroleum, the Prospectors and Developers Association of Canada and the joint Toronto Stock Exchange/Ontario Securities Commission Mining Standards Task Force.

In addition, it is anticipated that following completion of the Proposed Transaction the officers of the combined business will be Scott McLean (President and CEO), Greg Collins (Chief Operating Officer), Kevin Stevens (VP and Chief Geophysicist), and Anna Ladd (Chief Financial Officer).

Transaction Terms

Under the Proposed Transaction, and upon receipt of the requisite approvals, including regulatory and shareholder approvals, the parties will implement a plan of arrangement whereby all common shares of Transition will be consolidated on a 2:1 basis. HTX shareholders will receive shares of Transition at an exchange ratio of 0.8 post-consolidation Transition shares for each HTX share, and all shares of Transition held by HTX will be cancelled.

The Transaction, when completed, will be considered to be a reverse take-over for the purposes of the TSX Venture Exchange (the "TSXV") and the Resulting Issuer will be a Tier 2 Mining Issuer on the TSXV. For the purposes of the press release the term "Resulting Issuer" means the Company upon completion of the Transaction.

Transition Metals was spun out of HTX Minerals in 2010 to capitalize on the market for gold-focused resource companies, and went public in August, 2011 to provide HTX shareholders with some liquidity. While the two companies operate independently, they each follow the project generator business model, and have common CEOs, CFOs and IR/Marketing executives.

The current (unaudited) combined cash position for HTX Minerals and Transition Metals Corp. is $2.2 million, as of March 1, 2013.

Completion of the Proposed Transaction shall be subject to satisfactory completion by each party of due diligence, the negotiation of definitive agreements, the receipt of regulatory and required consents and approvals, including the approval of the Transition and HTX shareholders. The Parties acknowledge that the definitive agreement will contain customary and detailed conditions precedent, representations and warranties, covenants and provisions dealing with the mechanics of completing the Proposed Transaction as are typical for a transaction similar in nature to the Proposed Transaction. Neither Party is under any obligation to enter into any definitive agreement.

Completion of the Proposed Transaction is subject to a number of conditions, including TSXV acceptance and disinterested shareholder approval. The transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all. Investors are cautioned that, except as disclosed in the Management Information Circular to be prepared in connection with the transaction, any information released or received with respect to the Proposed Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Transition Metals should be considered highly speculative. The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

Timing

The Parties will use their reasonable commercial efforts to negotiate and complete the Formal Agreement in Q1, 2013, and plan to close the Proposed Transaction in Q2, 2013.

Qualified Person

The technical elements of this press release have been approved by Mr. Greg Collins (Transition), P.Geo (APGO), and by Mr. Kevin Stevens (HTX), P.Geo (APGO), each a Qualified Person under National Instrument 43-101.

About Transition Metals Corp

Transition Metals Corp (XTM -TSX.V) is a Canadian-based, gold-focused project generator that specializes in converting new exploration ideas into Canadian discoveries. The team has over 60 years of collective exploration experience in the established, emerging and historic mining camps of northern Ontario, and actively develops and tests new ideas for discovering gold mineralization in places that others have not looked, which often allows the company to acquire properties inexpensively. The team is rigorous in its fieldwork, and combines traditional techniques with newer ones to help unearth compelling prospects and drill targets. Transition's business model is to acquire and advance multiple grassroots exploration projects simultaneously, thereby maximizing shareholder exposure to discovery and capital gain. Joint venture partners fund a significant portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder's equity dilution. The company, which went public in 2011, has an expanding portfolio that currently includes 11 early stage gold projects in Ontario and British Columbia, two additional gold properties that are being explored by partners, and one sediment hosted copper project in Saskatchewan.

About HTX Minerals Corp.

HTX is a privately held Canadian exploration company that specializes in the discovery of new mineral deposits using a project-generator business model. This approach provides investors with the greatest growth potential and minimizes shareholder dilution through joint-venture funding partnerships and revenue generating opportunities. HTX was selected as the partner of choice by the Nunavut Resources Corporation and has a three-year $4.1 million strategic alliance with Implats, the world's second largest producer of platinum group metals. The company's founders have a +20 year track record of success, having discovered over 50 Mt of resources. HTX leverages this deep expertise with a proven methodology that combines custom-built digital compilations, advanced 3D geoscience modeling and interpretive techniques, and rigorous fieldwork to systematically identify economically attractive targets, including many that would otherwise go undiscovered.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in this news release constitutes "forward-looking information" within the meaning of Canadian securities law. Such forward-looking information may be identified by words such as "plans", "proposes", "estimates", "intends", "expects", "believes", "may", "will" and include without limitation, statements regarding estimated capital and operating costs, expected production timeline, benefits of updated development plans, foreign exchange assumptions and regulatory approvals. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, competition, risks inherent in the mining industry, and regulatory risks. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the Company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Mineralization at the Lupin Mine may not be representative of mineralization on the Itchen Lake property.

Further information is available on the Company websites at: www.transitionmetalscorp.com and www.htxminerals.com or by contacting:

Scott McLean

President and CEO

Transition Metals Corp. & HTX Minerals Corp. Tel: (705) 669-0590

George McTaggart

VP Investor Relations & Marketing – Transition Metals Corp. Marketing & Communications Officer – HTX Minerals Corp. Tel: (705) 669-0590

gmctaggart@transitionmetalscorp.com

DOWNLOAD PDF