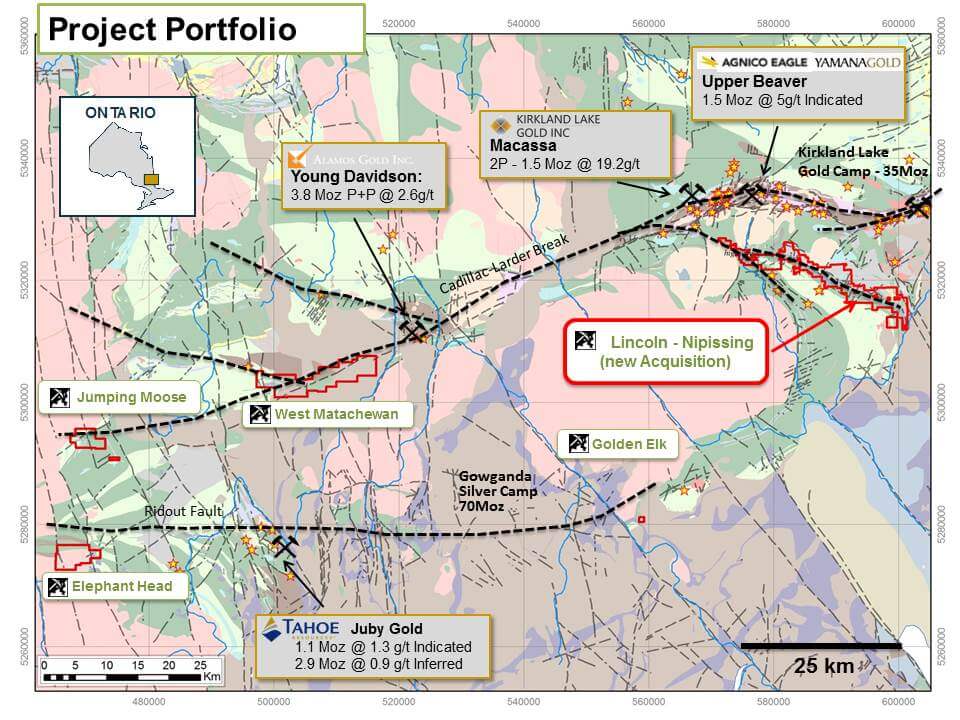

Sudbury, October 24, 2016 – Canadian Gold Miner (“CGM” or “the Company), a private company 65% owned by Transition Metals Corp (XTM – TSX.V) (“TMC”) is pleased to announce that it has optioned a 61 square kilometre property within the heart of Kirkland Lake Mining Camp from Skead Holdings Ltd (Skead). The property covers approximately 23 kilometres of strike along the Lincoln-Nipissing break. The Lincoln-Nipissing break is a deep seated fault structure located 10 kilometres south and parallel to the Cadillac-Larder Break.

Company CEO and president, Greg Collins, P.Geo. commented, “We see this acquisition as a unique opportunity to secure a camp scale property position in the heart of one of the world’s most prolific gold producing regions. The Lincoln-Nipissing project covers an under-explored region of the belt that is comparable in size to the entire Timmins or Kirkland Lake mining camps. The property hosts numerous high grade gold occurrences, some of which have been historically investigated underground and exhibit many characteristics associated with other well-known gold deposits in the prolific Abitibi Greenstone Belt.”

Under its agreement with Skead, Canadian Gold Miner can earn a 51% interest by incurring work expenditures totaling $2.75 million, issuing 600,000 common shares and providing $200,000 in cash payments over 3 years with an ability to earn up to a 100% interest by taking a project to commercial production subject to a $1.0 million commercial production payment. Once commercial production has been established, the property would be subject to a 2.5% NSR, of which 0.5% could be repurchased by the Company for $1.5 million.

About the Lincoln-Nipissing Property

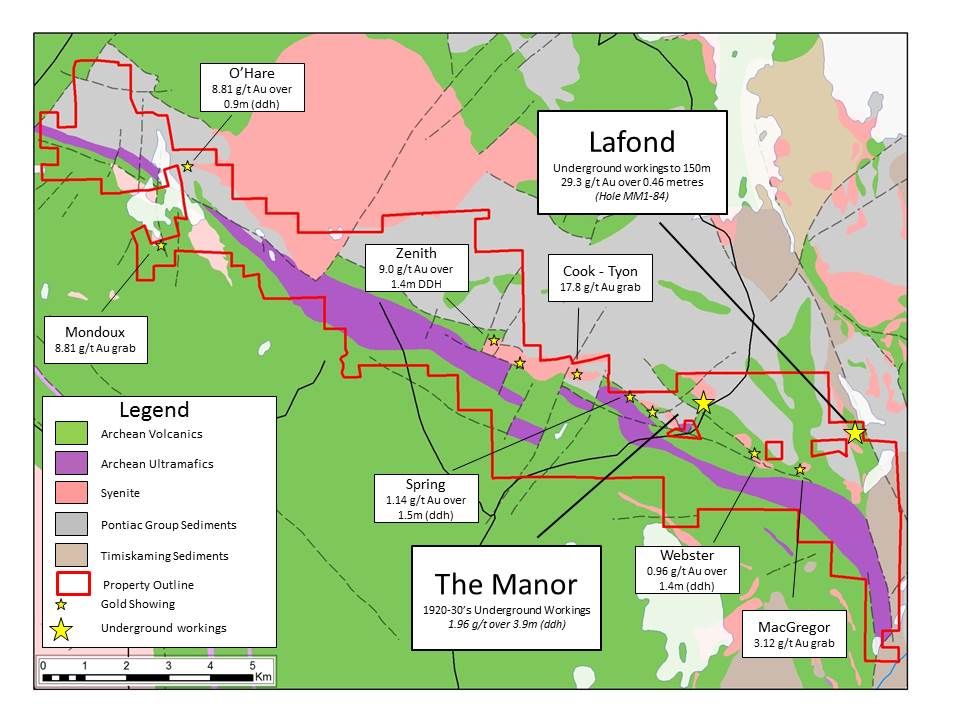

The Property (please refer to Figure 1.), consists of approximately 6,135 hectares of staked and leased mining claims extending through Boston, McElroy and Skead townships, approximately 10 kilometres south of Kirkland Lake. The property was recently explored by Gold Fields Limited which identified numerous gold showings returning assays from rock samples including, from west to east, the Mondoux (8.81 g/t Au), the O’Hare (1.8 ppm Au over 0.9 metres), Zenith (9.0 ppm Au over 1.4 metres), Cook-Tyon (17.8 g/t Au), Spring (2.32 g/t Au), Webster (1.06 g/t Au), and MacGregor (3.12 g/t Au).

Of particular interest to the Company are the historic Lafond and Manor deposits that were investigated by underground workings in the 1920’s and 1930’s. Unfortunately at these sites there is little or no record of production. In 2013 Gold Fields obtained grab samples from the Lafond site returning assay values ranging from 0.28 to 14.15 g/t Au. Grab sampling of rocks in the Lafond area by the Company in 2016 returned values from 0.16 to 2.59 g/t Au g/t Au. At Lafond, drilling conducted by Maple Mountain Mines in 1984 intersected 9.09 g/t Au over 1.68 m including 29.31 g/t Au over 0.46 metres (MM1-84).

The Company has initiated the compilation and interpretation of historically available exploration data and has sampled a number of locations on the property. The Company intends to carry out additional programs of mapping, sampling, and geophysics on the property and to initiate drilling around the Lafond deposit once permits have been issued.

Mineralization at the Lafond is hosted by an up to 125 metre wide altered syentitic dyke hosted in mafic to felsic metavolcanics and metasediments. The dyke has been traced by surface bedrock exposure for over 900 metres along strike and exhibits signs of widespread pervasive alteration and disseminated sulphides mineralization. Locally, the dyke is cut by a series of transverse quartz veins carrying higher concentrations of pyrite, chalcopyrite, molybdenite, tellurides, and gold that can extend into the surrounding host rocks. Historical channel samples on the No. 11 vein returned up to 20.6 g/t Au over 1.76 metres. A 152 metre shaft was sunk at the Lafond with drifting and crosscutting completed on the 100 foot level (30.48 metres) with stations cut at 300 and 500 feet (91.4 and 150 metres) during the 1920’s. In 1984, Maple Mountain Resources Ltd. conducted a program of drilling, trenching, and geophysics which included the dewatering and rehabilitating the shaft followed by a program of underground sampling. To date, only a total 13 drill holes have been reported for the Lafond area with 11 of those holes completed in the area of the shaft.

Qualified Person

The technical elements of this press release have been approved by Mr. Tom Hart, P.Geo. (APGO), a Qualified Person under National Instrument 43-101

About Canadian Gold Miner

Canadian Gold Miner Corp. is 65% owned by Transition Metals Corp (XTM –TSX-V) and, is a Canadian private corporation focused on exploring for gold in the Larder Lake Mining District near Kirkland Lake. The Company was founded by Transition to leverage its data, expertise and pipeline of exploration projects towards consolidating an extensive portfolio of high quality gold projects. CGM has assembled a dominant exploration land position in excess of 150 square kilometres around the Cadillac Larder, Lincoln-Nipissing and Ridout Structures in the southwestern part of the prolific Abitibi Greenstone belt in Ontario. The Abitibi is Canada’s most prolific gold district located in a stable political jurisdiction with excellent mining infrastructure in place.

Transition Metals Corp

Transition Metals Corp (XTM -TSX.V) is a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into Canadian discoveries. The award-winning team of geoscientists has extensive exploration experience in established, emerging and historic mining camps and actively develops and tests new ideas for discovering mineralization in places that others have not looked, which often allows the company to acquire properties inexpensively. The team is rigorous in its fieldwork and combines traditional techniques with newer ones to help unearth compelling prospects and drill targets. Transition uses the project generator business model to acquire and advance multiple exploration projects simultaneously, thereby maximizing shareholder exposure to discovery and capital gain. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder’s equity dilution. The company, which went public in 2011, has an expanding portfolio that currently includes more than 25 gold, copper, nickel and platinum projects primarily in Ontario, Nunavut and Saskatchewan.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in this news release constitutes “forward-looking information” within the meaning of Canadian securities law. Such forward-looking information may be identified by words such as “plans”, “proposes”, “estimates”, “intends”, “expects”, “believes”, “may”, “will” and include without limitation, statements regarding estimated capital and operating costs, expected production timeline, benefits of updated development plans, foreign exchange assumptions and regulatory approvals. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, competition, risks inherent in the mining industry, and regulatory risks. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the Company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information is available at www.transitionmetalscorp.com or by contacting:

Greg Collins

President and CEO

Canadian Gold Miner Corp.

Tel: (705) 669-0590

Scott McLean

President and CEO

Transition Metals Corp.

Tel: (705) 669-0590

Figure 1: Location of Lincoln-Nipissing Property in the Kirkland Lake Mining Camp.

Figure 2: Key Showings and Highlight Results on the Lincoln-Nipissing Property