06 April 2017

Sudbury, April 6, 2017 – Transition Metals Corp. (XTM – TSX.V) (“Transition”) is pleased to report additional assay results from drilling at the Haultain discovery on the Gowganda Gold Project located near Kirkland Lake Ontario. Work on the Gowganda Gold project is being funded by option partner Aldershot Resources Ltd. which is earning an interest in the project. Highlights from the latest round of drilling include 11.52 metres grading 1.63 grams per tonne gold (g/t) including 6.21 g/t over 1.08 metres and 5.41 g/t over 1.03 metres. Previous highlights from drilling in 2017 include 9.10 metres grading 1.24 g/t including 2.4 metres grading 3.04 g/t in hole TMH-17-023 and 5.90 metres grading 1.43 g/t including 1.3 metres grading 3.79 g/t gold. A summary of the 2017 drilling results are provided in Table 1.

Transition CEO Scott McLean commented that “The program has highlighted the presence of a robust gold system that appears to be getting stronger at depth. Additionally, the results have generated some new insights into the relationship between northwest oriented shear zones and gold on the property which have led to the identification of some new target areas on the property. One such area is highlighted by a strong 500 metre by 200 metre apparent resistivity anomaly in the vicinity of the NW Shear along strike and at depth from elevated mineralization intersected by multiple holes near surface. Additional drilling to at depth and along strike to test this target and to pursue identified grade thickness trends is warranted.”

Discussion of Drill Results:

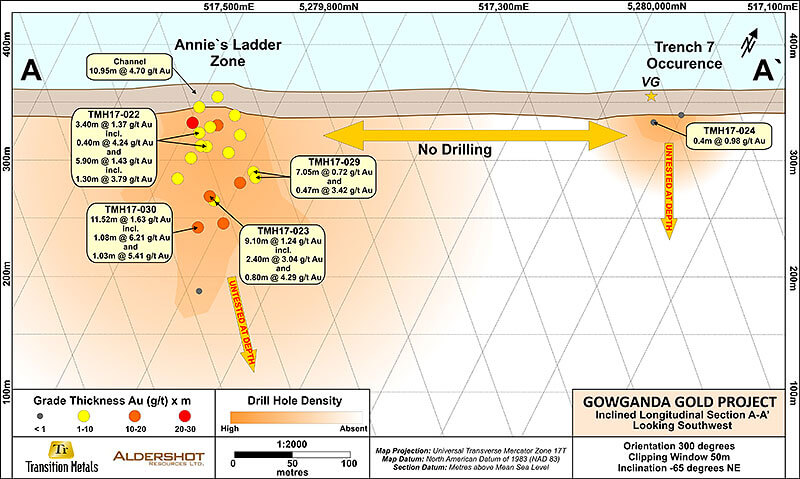

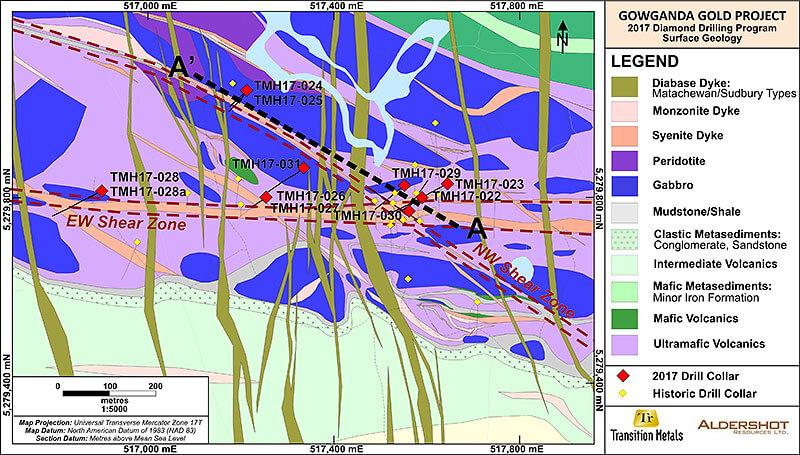

In 2017, 11 holes, totaling 1418.9 metres have been completed. A plan map depicting the location of holes completed on an interpretation of the bedrock geology is depicted in Figure 1. Figure 2 depicts the location of drill holes on a backdrop of contoured apparent resistivity. Figure 3 presents an inclined longitudinal section depicting the location of drill holes testing along the trend of the Northwest Shear. If you cannot view the figures associated with this release they can be viewed at:

Holes TMH-17-022, 23, 29 and 30 targeted extensions to previously identified mineralization exposed in surface trenches and shallow drilling in the vicinity of the Annie’s Ladder showing. The Annie’s Ladder zone occurs at the intersection of the North West Shear and the East West Shear Zones. Holes TMH-17-022 and 23 (results released March 1, 2017) and TMH-17-30 targeted the down plunge continuation of stockwork veining exposed at surface. Hole TMH-17-30 was collared atop the Annie’s ladder showing and drilled to the North East to test for the presence of flat vein systems as well as to the confirm orientation of veining systems down plunge. Hole TMH-17-029 stepped out 50 metres northwest of TMH-17-022. All holes completed in the vicinity of the Annie’s Ladder zone intersected broad zones of hydrothermal alteration and mineralization within the host syenite dyke package, grading 0.72 g/t over 7.05 metres in TMH-17-029 and 1.63 g/t over 11.52 metres in TMH-17-030.

Holes TMH-17-24 and 25 tested a portion of the North West shear beneath a trenched exposure of narrow quartz veining hosting coarse visible gold. Hole TMH-17-24 intersected 0.40 metres grading 0.98 g/t gold. No significant gold values were returned from TMH-17-25.

Hole TMH-17-28 and 28b were collared to test an induced polarization chargeability target in an area under swamp cover along trend from prospective areas exposed at surface. Poor ground conditions resulted TMH-17-28 being abandoned at 54 metres and re-collared as hole TMH-17-28a. TMH-17-28a encountered a thick sequence of magnetite bearing ultramafic rocks, interpreted to be the cause of the chargeability feature.

Holes TMH-17-26, 27 and 31 targeted a portion of the main syenite dyke swarm approximately 200 metres west of the Annie’s Ladder showing close to a trenched exposure of an altered, mineralized syenite hosting visible gold. All holes intersected broad zones of alteration and veining within a variety of lithologies including syenite. Hole TMH-17-26 intersected 0.40 g/t Au over 6.91 metres from 44.84 to 51.75 metres. Hole TMH-17-27 intersected 0.71 g/t Au over 2.13 metres from 44.84 to 51.75 metres. Hole TMH-17-31 was planned to test a strong apparent resistivity anomaly interpreted to occur down plunge from holes TMH17-26 and TMH17-27. The hole intersected 3 narrow intervals of elevated gold mineralization including 1.15 metres grading 2.99 g/t gold, but a conclusive explanation for the source of the apparent resistivity anomaly was not identified. This area remains a high priority target for future drilling programs.

Table 1.

| Hole | From (m) | To (m) | Length (m) | Au (g/t) |

| TMH17-031 | 120.88 | 123.71 | 2.83 | 0.39 |

| and | 171.66 | 173.15 | 1.49 | 0.85 |

| and | 191.09 | 192.24 | 1.15 | 2.99 |

| TMH17-030 | 120.6 | 132.12 | 11.52 | 1.63 |

| including | 122.1 | 123.18 | 1.08 | 6.21 |

| including | 128.9 | 129.93 | 1.03 | 5.41 |

| TMH17-029 | 69.15 | 76.2 | 7.05 | 0.72 |

| and | 84.58 | 85.05 | 0.47 | 3.42 |

| TMH-17-028 | Hole lost at 54 m. No sig Values. | |||

| TMH-17-028a | No sig Values. | |||

| TMH-17-027 | 71.6 | 73.73 | 2.13 | 0.71 |

| TMH-17-026 | 44.84 | 51.75 | 6.91 | 0.40 |

| TMH-17-025 | No sig Values. | |||

| TMH-17-024 | 28 | 28.4 | 0.4 | 0.98 |

| 1TMH-17-023 | 110.4 | 119.5 | 9.1 | 1.24 |

| including | 114.6 | 117 | 2.4 | 3.04 |

| including | 115.6 | 116.4 | 0.8 | 4.29 |

| 1TMH-17-022 | 45.1 | 48.5 | 3.4 | 1.37 |

| including | 48.1 | 48.5 | 0.4 | 4.24 |

| and | 55.6 | 58.6 | 3 | 1.22 |

| and | 75.7 | 81.6 | 5.9 | 1.43 |

| including | 80.3 | 81.6 | 1.3 | 3.79 |

*Gold values are reported in grams per tonne.

** Length intervals are actual widths in metres and may not be representative of true thickness

¹ Results from TMH-17-022 and TMH-17-023 previously released. See news release dated March 1, 2017

About the Gowganda Gold Project

The project is subject to an option and joint venture agreement with Aldershot Resources Ltd. Under the terms of the agreement Aldershot can earn up to a 75% interest in the property from Transition. To earn a 51% interest in the Property, Aldershot has committed to funding $400,000 worth of exploration on property in year one and must incur cumulative work expenditures totaling $2.0 million by the third anniversary of the agreement. In addition, Aldershot must issue 1,500,000 common shares to Transition on signing (received), and provide an additional $450,000 worth of Aldershot shares to Transition by the second anniversary date, subject to exchange approvals to earn its initial interest. During the course of the initial stage of the Option, Transition has agreed to serve as program Operator, dedicating its team and expertise to overseeing work programs funded by Aldershot. Upon earning an initial 51% interest, Aldershot may opt to acquire an additional 24% interest in the Property (for a total of 75%) by completing a feasibility study within 3 years. Upon Aldershot earning its 51% or 75% interest in the Property as the case may be, a Joint Venture would be formed, with each party being required to fund work programs on the property to maintain its respective interest.

The project is focused on Archean greenstone overlain by Proterozoic sediments of the Cobalt Embayment located south of the Round-Lake Batholith in the south-western part of the prolific Abitibi greenstone belt. Gold mineralization on the property is in part controlled by the emplacement of syenitic intrusions that are locally altered and mineralized. High grade, nugget like gold mineralization occurs within quartz veining within the altered syenite. A short animated video that introduces the Gowganda Gold project may be viewed at: http://www.transitionmetalscorp.com/projects/partnered-projects/gowganda-gold.

Qualified Person

The technical elements of this press release have been approved by Mr. Tom Hart, P.Geo., a Qualified Person under National Instrument 43-101. All core samples were half sawn at a controlled location by Company representatives under the supervision of Mr. Steve Flank, P.Geo, and transported directly by the company to the lab. Transition Metals employs in-house QA/QC procedures that conform to industry best practices. All analytical work performed on core samples was conducted at ALS-Chemex with sample preparation completed in Sudbury, Ontario and analyses completed in North Vancouver, B.C. The quality system used by ALS-Chemex complies with international standards ISO 9001:2000 and ISO 17025:2005.

About Transition Metals Corp

Transition Metals Corp (XTM -TSX.V) is a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into Canadian discoveries. The award-winning team of geoscientists has extensive exploration experience in established, emerging and historic mining camps and actively develops and tests new ideas for discovering mineralization in places that others have not looked, which often allows the company to acquire properties inexpensively. The team is rigorous in its fieldwork and combines traditional techniques with newer ones to help unearth compelling prospects and drill targets. Transition uses the project generator business model to acquire and advance multiple exploration projects simultaneously, thereby maximizing shareholder exposure to discovery and capital gain. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder’s equity dilution. The Company has an expanding portfolio that currently includes more than 25 gold, copper, nickel and platinum projects primarily in Ontario, Nunavut, British Columbia, Minnesota and Saskatchewan.

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in this news release constitutes “forward-looking information” within the meaning of Canadian securities law. Such forward-looking information may be identified by words such as “plans”, “proposes”, “estimates”, “intends”, “expects”, “believes”, “may”, “will” and include without limitation, statements regarding estimated capital and operating costs, expected production timeline, benefits of updated development plans, foreign exchange assumptions and regulatory approvals. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, competition, risks inherent in the mining industry, and regulatory risks. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the Company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information is available at www.transitionmetalscorp.com or by contacting:

Scott McLean

President and CEO

Transition Metals Corp.

Tel: (705) 669-0590

Figure 1.

Figure 2.

Figure 3.