16 November 2015

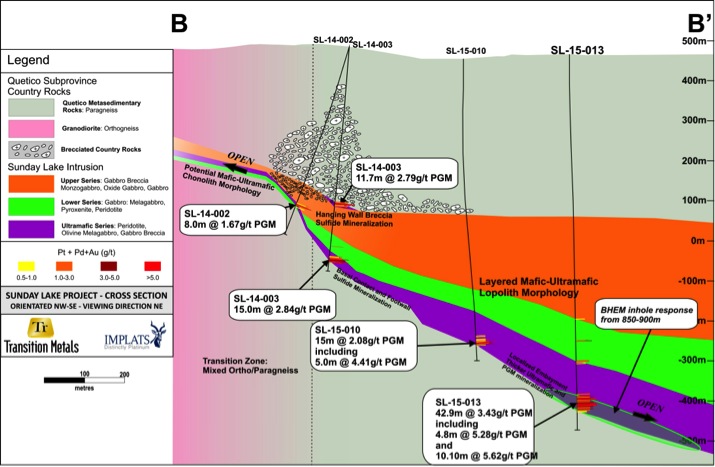

Sudbury, November 16, 2015 – Transition Metals Corp. (XTM – TSX.V) (“Transition”, “the Company”) and Impala Platinum Holdings Limited (Implats) are pleased to announce that Hole SL-15-013 intersected 42.90 metres averaging 3.43 g/t PGM (Pt+Pd+Au) including 10.10 metres of 5.61 g/t PGM associated with basal contact mineralization. This newly identified high grade zone appears to be hosted within a topographical depression associated with the basal contact of a thickened ultramafic package which remains open in all directions. The drilling program, funded by Implats, (Joint Venture 75%Implats and 25% Transition) has been effective at expanding the known limits of the mineralized envelope at Sunday Lake to a mineralized corridor extending at least 400 metres by 800 metres in lateral extent with thicknesses ranging from 3 to 43 metres hosting multi-gram PGM’s.

President & CEO Scott McLean commented: “The latest results at Sunday Lake represent the longest and highest grade PGM mineralization to date on the property and continue to demonstrate the continuity of the PGM mineralization. The overall PGM grades we are seeing are comparable to those being commercially exploited at the nearby Lac des Isles Mine except that the mineralization at Sunday Lake contains significantly higher concentrations of platinum as well as an appreciable amount of nickel and copper. The thickening of the zone indicated in hole SL-15-013 appears to correspond to an embayment-type feature which is a very prospective environment to host significant tonnages of high grade material in a relatively small area.”

Highlight assay results are:

| Drill Hole | From (m) | To (m) |

Length* (m) | Pt (g/t) |

Pd (g/t) |

Au (g/t) |

PGMs (g/t) | Cu (%) |

Ni (%) |

| SL-15-012 | No significant Mineralization | ||||||||

| SL-15-013 | 715.7 | 718.2 | 2.5 | 1.00 | 0.69 | 0.10 | 1.79 | 0.14 | 0.04 |

| And | 767.0 | 771.1 | 4.1 | 0.73 | 0.64 | 0.06 | 1.43 | 0.26 | 0.11 |

| And | 849.7 | 892.6 | 42.9 | 1.92 | 1.40 | 0.11 | 3.43 | 0.44 | 0.17 |

| including | 860.8 | 865.6 | 4.8 | 2.87 | 2.24 | 0.16 | 5.28 | 0.68 | 0.22 |

| including | 871.4 | 881.5 | 10.1 | 3.18 | 2.28 | 0.16 | 5.61 | 0.71 | 0.28 |

| including | 880.5 | 881.5 | 1.0 | 5.72 | 3.33 | 0.31 | 9.36 | 0.74 | 0.24 |

| SL-15-014 | No intrusion intersected | ||||||||

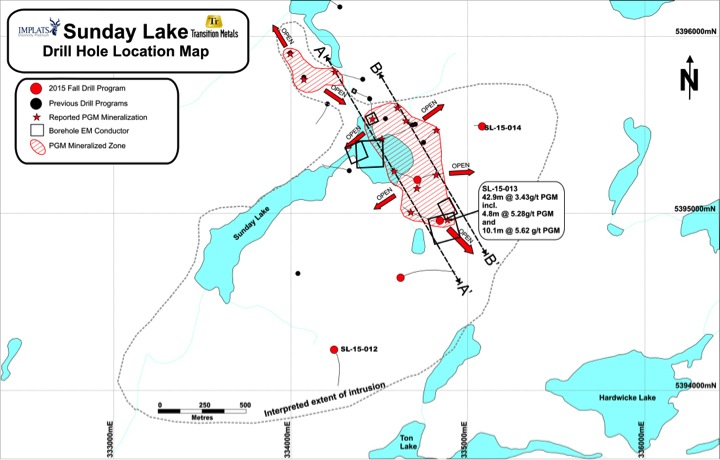

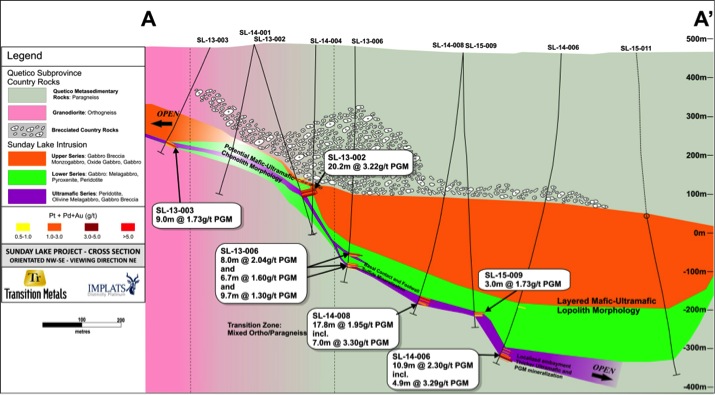

Intersections interpreted to be close to true thickness. Please refer to Figures 1 to 3 which present a plan map of drilling and interpreted geological cross sections showing the location of drill holes and assay results relative to previous drilling.

A borehole time domain electromagnetic (BHEM) survey was completed by Crone Geophysics in-hole SL-15-013 which showed a significant conductive response to mineralization below 850 metres. Interpretation of this response indicates that the borehole intersected the source horizon near its up-dip edge and that the conductive zone dips shallowly and extends to the south and east of the borehole as shown in Figures 1 and 3 attached. In addition an off-hole response was logged near the borehole at the bottom of the mineralized zone located north of the hole. Target areas are indicated on the plan map.

Kevin Stevens, Transition’s Chief Geophysicist comments “The BHEM response that is associated with the mineralization in SL-15-013 indicates that BHEM should be useful to assist with follow-up drill targeting even in this relatively low sulphide environment.”

Discussion of Results

Results from the fall program highlight the intrusion's potential to host an economic PGM-Cu-Ni deposit. Thick intersections of gabbroic breccias, ultramafic lithologies and hydrothermally altered country rocks suggest the Sunday Lake Intrusion (SLI) is a relatively large, primitive and contaminated intrusion that has been dynamically emplaced. Platinum group mineralization intersected continues to be platinum-rich and of (exceptional) higher grade tenor. Figures 2 and 3 are cross-sectional interpretations of the geology and mineralization along section lines A-A’ and B-B’ shown in Figure 1 and include assay highlights presented in this release.

SL-15-012 (956.0m: 150°/-80°): Intersected 507.5 metres of the SLI from 448.5 to 956.0 metres. The hole was shut down prior to intersecting the basal contact of the intrusion, which was deeper than the anticipated depth.

SL-15-013 (941.0m: 45°/-80°): Intersected 485.1 metres of the SLI from 407.5 to 892.6 metres. A 43.2 metre wide zone of varitextured melagabbro with blebby and disseminated chalcopyrite+pyrhotite+pyrite mineralization was intersected from 849.7 to 892.6 metres which returned assay values of 3.43 g/t PGMs, 0.44% Cu and 0.22% Ni. Included within this interval was a 10.1 metre thick high grade core of 5.62 g/t PGMs, 0.71% Cu and 0.28% Ni from 871.4 to 881.5 metres and 1 metre of 9.36 g/t PGMs, 0.84% Cu and 0.24% Ni from 880.5 to 881.5 metres.

SL-15-014 (536.0m: 20°/-87°): Failed to intersect the main mass of the SLI but intersected a series of narrow SLI related mafic sills between 315.8 and 362.3 metres before being shut down at a depth of 536.0 metres.

About the Sunday Lake Project

The Sunday Lake PGM-Cu-Ni discovery is located approximately 25 kilometres north of Thunder Bay and 25 kilometres west of Panoramic's Thunder Bay North PGM deposit (Indicated Resource of 9.83 Mt @ 2.87 g/t Pt-Eq and Inferred Resource of 0.53 Mt @ 2.87 g/t Pt-Eq) ¹ which is jointly held by Rio Tinto Exploration Canada and Panoramic Resources, and approximately 100 kilometres south by road from producing PGM mine and mill operations at Lac des Iles. The Lac des Iles mine is owned and operated by North American Palladium Ltd. and produced 174,194 Oz of palladium (Pd) by mining 2,637,023 tonnes grading 2.6 g/t Pd in 2014 ². The Sunday Lake project covers a 3.5 kilometre diameter circular reversely-polarized magnetic anomaly associated with a large buried mafic-ultramafic intrusion interpreted to be Proterozoic in age and related to the Midcontinental Rift (MCR).

In January of 2014 the company announced a discovery hole intersecting 20.2 metres grading 3.22 g/t combined PGMs. In April of 2014, Transition and Implats were awarded the Bernie Schneider’s Discovery of the Year Award in recognition for this discovery. PGM mineralization at Sunday Lake is exceptionally platinum rich with tenors exceeding 2:1 platinum to palladium observed.

The Sunday Lake Project is a Joint Venture between Implats and Transition Metals owned 75% by Implats and 25% by Transition Metals. Under the terms of the Joint Venture, Implats is to provide all funding until the completion of a bankable feasibility study.

¹ Resource reported by Panoramic Resources, Thunder Bay North deposit: 2011 JORC compliant mineral resources estimate prepared by AMEC Americas Ltd.

² Operational Highlights from North American Palladium Ltd.’s 2014 Annual Report filed at Sedar.com

Qualified Person

The technical content of this news release has been reviewed and approved by Mr. Grant Mourre, P.Geo (APGO), a Qualified Person under National Instrument 43-101. All samples were analyzed in Vancouver by ALS Chemex. Platinum, palladium and gold values were determined together using standard lead oxide collection fire assay and ICP-AES finish. Base metal values were determined using a four acid digest and ICP-AES finish. A Certified Reference Material (CRM) standard, blank or duplicate is inserted on every 10th sample in the following order: CRM, blank, CRM, duplicate. The cycle repeats every 40 samples, thus ensuring that 10% of samples submitted are control samples. Laboratory checks are also done with one sample in every batch (max 40 samples) being submitted to an external lab for comparison.

About Sudbury Platinum Corporation

About Transition Metals Corp.

Transition Metals Corp (XTM -TSX.V) is a Canadian-based, multi-commodity project generator that specializes in converting new exploration ideas into Canadian discoveries. The award-winning team of geoscientists has extensive exploration experience in established, emerging and historic mining camps and actively develops and tests new ideas for discovering mineralization in places that others have not looked, which often allows the company to acquire properties inexpensively. The team is rigorous in its fieldwork and combines traditional techniques with newer ones to help unearth compelling prospects and drill targets. Transition uses the project generator business model to acquire and advance multiple exploration projects simultaneously, thereby maximizing shareholder exposure to discovery and capital gain. Joint venture partners earn an interest in the projects by funding a portion of higher-risk drilling and exploration, allowing Transition to conserve capital and minimize shareholder’s equity dilution. The company, which went public in 2011, has an expanding portfolio that currently includes more than 25 gold, copper, nickel and platinum projects primarily in Ontario, Nunavut and Saskatchewan.

About Impala Platinum Limited

Implats is in the business of mining, refining and marketing of platinum group metals (PGMs), as well as nickel, copper and cobalt. The group produces approximately 22% of the world's supply of primary platinum and in FY2014 produced 2.370 million ounces of PGMs, including 1.178 million ounces of platinum. Implats’ mining interests are found on the two most significant known platinum group mineral-bearing orebodies in the world: The Bushveld Complex in South Africa and The Great Dyke in Zimbabwe. Impala Refining Services (IRS) takes advantage of Impala’s excess smelting and refining capacity to process the concentrate and matte produced by the various mine-to-market group operations as well as material purchased from third party companies. Toll-refining is also undertaken on behalf of other companies. Implats has a primary listing on the JSE (IMP). The share may also be traded via a sponsored level 1 ADR programme (IMPUY).

Cautionary Note on Forward-Looking Information

Except for statements of historical fact contained herein, the information in this news release constitutes “forward-looking information” within the meaning of Canadian securities law. Such forward-looking information may be identified by words such as “plans”, “proposes”, “estimates”, “intends”, “expects”, “believes”, “may”, “will” and include without limitation, statements regarding estimated capital and operating costs, expected production timeline, benefits of updated development plans, foreign exchange assumptions and regulatory approvals. There can be no assurance that such statements will prove to be accurate; actual results and future events could differ materially from such statements. Factors that could cause actual results to differ materially include, among others, metal prices, competition, risks inherent in the mining industry, and regulatory risks. Most of these factors are outside the control of the Company. Investors are cautioned not to put undue reliance on forward-looking information. Except as otherwise required by applicable securities statutes or regulation, the Company expressly disclaims any intent or obligation to update publicly forward-looking information, whether as a result of new information, future events or otherwise. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Further information is available at www.transitionmetalscorp.com or by contacting:

Scott McLean

President and CEO

Transition Metals Corp.

www.transitionmetalscorp.com

Tel: (705) 669-0590

Figure 1: Plan Map of the Sunday Lake Property and Drill Hole Collar Locations

Figure 2: Vertical Cross Section A-A’, Sunday Lake Project

Figure 3: Vertical Cross Section B-B’